The Hammer Blast pattern

The inventor of this pattern is technical analyst Stefan Salomon.

The advantages of the Hammer Blast pattern

• The pattern is designed and used by a technical analyst.

• The pattern can be used for all market indices (DOW, DAX, CAC, AEX ...) and stocks.

• The pattern is clearly defined and easy to understand.

• The pattern is rare but the historic results are very attractive.

About the Hammer Blast pattern

The pattern ...

• Identifies market rebounds.

• Can be used for market indices and stocks.

• Can be used in all time frames.

• Provides only buy signals.

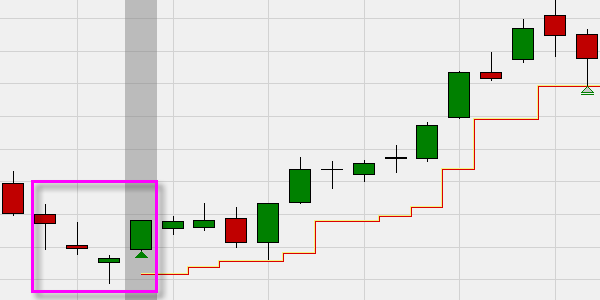

The Hammer Blast candlestick pattern consists of four candles. The two first candles need to be bearish candles. The third candle needs to be a Hammer candle. The fourth candle must be a bullish candle. The open of the fourth candle must be above the close of the Hammer candle. A position is bought at the market price immediately after completion of the pattern.

This example shows a Hammer Blast pattern detected by the NanoTrader on Apple.

This example shows a Hammer Blast pattern detected by the NanoTrader on the French market index CAC 40.

The Hammer Blast candlestick pattern is also available in to NanoTrader Full as a ready-to-use screener, trading signal and trading strategy.